As 2021 drags on, a new MLCC spot shortage is forcing some industries to be agile and adapt to supply chain volatility.

More than halfway into 2021, and the automotive chip shortage is still raging on. Even as companies like Intel and TSMC are making investments in additional fab capacity, many in the industry and in the financial sector expect shortages to continue through 2021. The price tag is staggering as well, with estimates now topping $100 billion in terms of lost revenue to the automotive industry alone.

Shortages of electronic components are nothing new in 2020 and 2021. In 2020, it was due to everyone staying home, either due to furloughs, panic buying, excessive demand for work-from-home electronics, and/or forced lockdowns. In 2021, it seems pent-up consumer demand, CAPEX, and investments in reopening plays are creating shortages in everything from lumber to plastics.

A recurring shortage that has its roots in 2017 is the multilayer ceramic capacitor (MLCC) shortage. The shortage for these components started to reach worrying levels in 2018, followed by a respite in 2019. In 2020, obvious issues with worldwide manufacturing capacity due to COVID-19 reignited fears of an MLCC shortage. In mid-2021, fear of an MLCC shortage continues due to supply chain issues for industrial, medical, and military systems, especially now that more than one manufacturer has sounded alarm bells. Now there is some question as to whether a full-blown shortage will extend beyond these particular industries and affect the broader electronics market. If you’re planning a design that will need MLCCs, you may want to plan for alternatives in the event your required components are out of stock with long lead times.

Who Might Be Affected by an MLCC Shortage in 2021?

The current wave of the MLCC shortage is affecting multiple industries beyond automobiles. Certainly, automobiles need capacitors in addition to a huge range of other electronics, but the industries making the most recent headlines are defense electronics, medical devices, and industrial automation.

So is this a supply-driven or demand-driven shortage? Interestingly, the inventory problem in these industries is a bit of both. Some of the products driving consumption of MLCC stocks include:

Lower power radars, radios, and wireless networking products running at GHz frequencies

5G-capable equipment, such as handsets, IoT products, base station equipment, and other telecom equipment

Consumer electronics (laptops, smartphones, etc.), which require many more MLCCs today than they did just a few years ago

The MLCCs in these products are used in high quantity and come in small-case capacitors (

As a result, industrial, medical, and military products that require high-voltage, high-Q MLCCs are feeling pressure from a reduction of MLCC inventory in larger case sizes. The affected products include power supplies/regulators, MRI coils, amplifiers, lasers, and many other specialized products that require larger cases.

Who’s Sounding the Alarm?

Warnings of a potentially new wave in the MLCC shortage are not new. In November 2020, passive component distributor TTI released a letter to their customers outlining their expectations for longer-than-normal lead times for large-case MLCCs (>0603 packages), with lead times extending up to 20 weeks or longer. In addition, the growth in consumer electronics production over 2020 and continued increase in smartphone purchases in Q1-Q2 2021 are placing greater demand pressure on smaller MLCC packages throughout the supply chain.

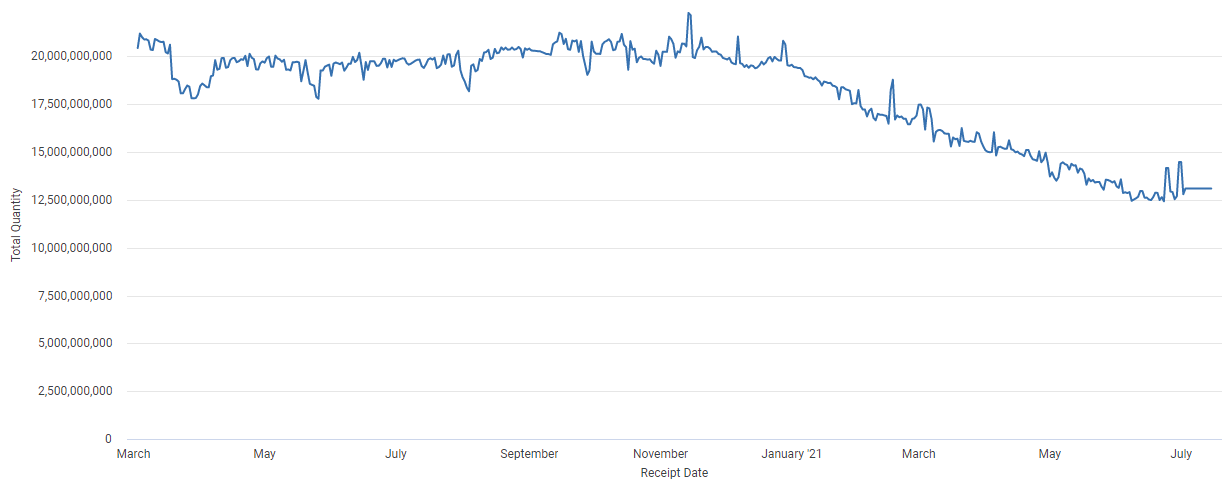

A look at some supply chain data from the beginning of the pandemic until the end of June sheds more light on the story. The graph below shows total ceramic capacitor stocks over the prior 18 months. Beginning in November 2020, coinciding with the time TTI released their letter, we see MLCC stocks begin steadily decreasing, with global inventory dropping by approximately 35% over the following 8 months (summed across all distributors).

Total ceramic capacitor inventory across all distributors from 3 March 2020 until 30 June 2021.

From looking at the above graph, it’s hard to call this a shortage. A notable recent claim of an MLCC shortage came from Scott Horton at Johanson Technology (first reported in Embedded Computing on May 27), an MLCC manufacturer serving the automotive industry. This is the first instance (to my knowledge) that anyone has used the term “shortage” to describe the steady decrease in capacitor stocks. A look at inventory data for Johansen’s ceramic capacitor stocks hints at why they’ve sounded the alarm. Their inventory recently saw an approximately 16% drop over the same period and has remained low due to high demand.

Total ceramic capacitor inventory for Johanson Technologies across all distributors from 3 March 2020 until 30 June 2021.

Adapting to Shifting Supply

To accommodate last year’s growth in demand for consumer electronics (mostly smartphones, tablets, and other products), much of the manufacturing capacity for MLCCs has shifted from high-Q/high-voltage capacitors to capacitors in physically smaller cases and lower-Q values. These physically smaller components tend to have lower voltage ratings and higher self-resonances; the low voltage ratings in smaller case sizes makes them less useful in the affected industries. In addition, tight clearance constraints in smaller consumer devices limits the use of larger case sizes as these may not fit inside the smaller enclosures used for consumer devices.

Given the demand across case sizes and shifting capacity towards consumer electronics, I don’t think we should be surprised at these developments. In contrast to the situation in 2018, the data for total inventory across distributors shows that it’s difficult to call this a full-blown MLCC shortage because, as noted above, it’s not affecting all industries or manufacturers. However, there has been a steady reduction in inventory across the supply chain. This underscores the need for design teams to plan ahead and consider substitutes for their products.

Currently, U.S. EMS providers are shifting their onshored capacity or bringing new capacity online to address shortages across the supply chain. Time will tell how this specific portion of the capacitor market will fare and if demand continues depleting capacitor stocks in the long term. In the meantime, PCB designers and engineers need to consider how to adapt their designs to withstand an MLCC shortage and continue bringing products to market.

It’s Not a Shortage Yet, But Plan For Substitute Components

As much as we would like ramped up capacity in the US and Southeast Asia to be immediate and permanent, no one can predict the future. Should stocks for MLCCs stabilize once the global economy cools off in the post-recovery phase, that capacity may get shifted to other products. It’s tempting to assume we’ll be back into the relative surplus mode we were in during 2019. However, the recent push by the Biden administration to onshore manufacturing capacity for semiconductors could also extend to MLCCs and other components, so don’t expect American capacity to go offline or get diverted once the shortage subsides.

While the shortage is still in play, it’s important for designers to consider how they can accommodate alternative components in their designs. Compared to semiconductor shortages, particularly automotive-qualified IC shortages, an MLCC shortage is somewhat easier to deal with in some cases. There are a number of reasons companies can more easily adapt to volatility in the MLCC supply chain compared to an IC shortage:

Combining capacitors: Capacitors can be combined in parallel or series to give the required capacitance, something which is not possible with ICs. However, this creates a problem if you’re operating at frequencies where parasitics dominate in the design, such as in the PDN for digital components.

Finding substitutes: Not all ICs drop-in replacements, even from the same manufacturer. This means a design variant generally needs to be created if an IC is unavailable. In contrast, SMD MLCCs will come in standard package sizes, so you can typically find an alternative component without changing the design.

In either case, there will be some minor modifications needed in a design in the event your desired MPN is unavailable. Working with substitutes is the ideal solution, although it is common to combine multiple capacitors into series or parallel arrangements to produce the desired capacitance.

Combining Capacitors

Taking multiple capacitors and combining them in series and parallel to produce the desired equivalent capacitance may sound simple enough. At sufficiently low frequencies, you won’t have to worry about parasitics in capacitors. However, MLCCs are intended for operation at very high frequencies, particularly for decoupling in the PDN on a PCB, and for use in building filter circuits for RF designs. When combining substitute MLCCs or alternative capacitors, the goal is to get a desired capacitance value without moving the equivalent capacitor self-resonant frequency to a lower frequency that would be undesired.

At low frequencies, this is not often considered, even though it’s very common to use banks of capacitors in parallel to get to a desired capacitance. At high frequencies used in MLCCs, there are only two specifications that should receive attention when selecting alternative components and combining them:

Voltage rating: MLCCs can have high voltage ratings, but the actual voltage across an individual capacitor in a bank of capacitors will depend on how the equivalent circuit is designed.

Equivalent series inductance (ESL): The ESL value is in series with the capacitance when we view a capacitor from the circuit model perspective. The ESL value is what creates the self-resonance in a real capacitor, and series or parallel combinations could have a shifted self-resonant frequency compared to the value for a single capacitor.

Just as an example, if you combine multiple MLCCs with different specifications in series to give the equivalent capacitance of a smaller MLCC, the ESL values will add together. The equivalent self-resonant frequency will be a complex average of the two self-resonances. If the self-resonant frequency becomes too low as you add more capacitors in series, the equivalent circuit will eventually stop acting like a capacitor as the total ESL becomes too high and the equivalent self-resonant frequency gets too low, which defeats the purpose of using MLCCs to begin with. In this example situation, where multiple MLCCs are combined in series, you might consider using alternative MLCCs with higher self-resonant frequencies and use these in a series combination as a substitute for a smaller capacitor.

Working With Same-Capacitance Substitutes in Your Design

Although MLCC stocks are in flux, you might be able to find an alternative component in a different package size, but with the same capacitance. Make sure to pay attention to the two main specifications listed above. Ideally, when selecting an alternative component, you want the voltage rating and the self-resonant frequency to be higher while maintaining the same capacitance for safety and performance purposes. Unfortunately, this is usually not possible in general.

Since you won’t always find the same capacitance in the same package size, it’s important to consider how different case sizes might have different voltage and ESL ratings. If you choose a physically smaller MLCC to substitute for your unavailable component, you tend to get the benefit of the same or larger self-resonance as physically larger SMD components tend to have smaller ESL. However, the component may have a lower voltage rating for a given capacitance, which can only be compensated by placing the caps in series. Both factors should be considered as they impact RF power integrity applications and RF filtering applications.

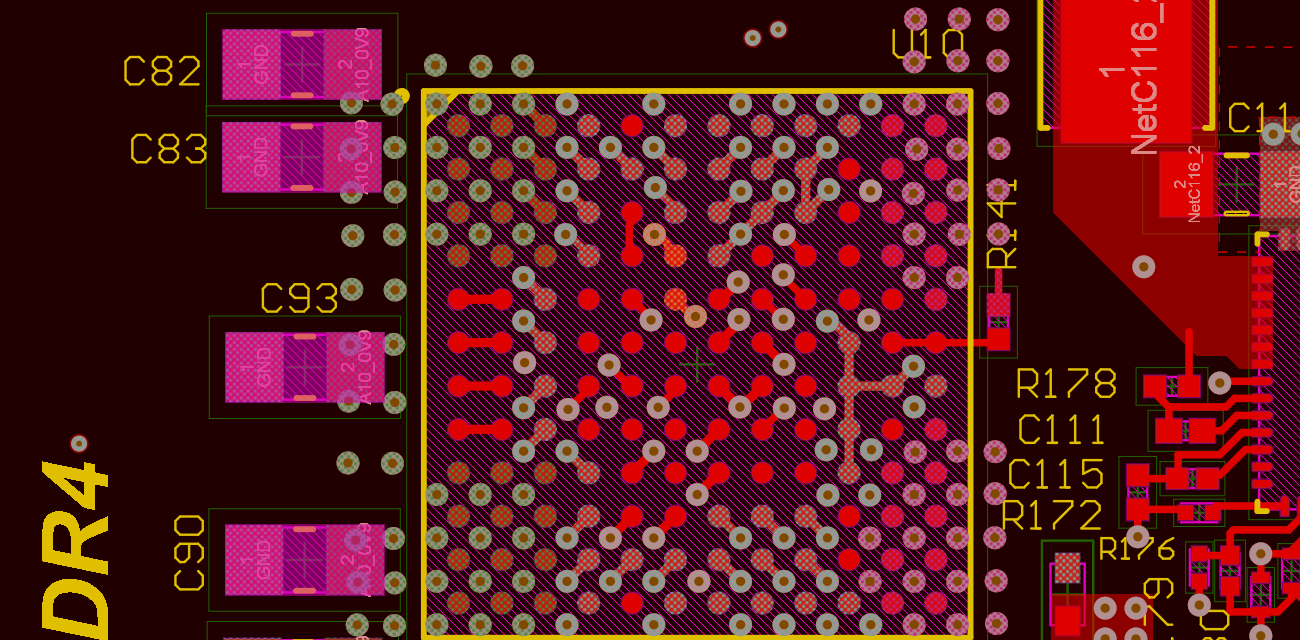

It’s much easier to swap out these MLCCs for slightly larger capacitor footprints if they are out of stock.

Although a larger case will have different specs, it’s much easier to modify a PCB layout to have a slightly different case size than it is to modify a design with multiple caps in parallel. How you layout the board is also important as board-level parasitics will affect signal integrity in the design.

Supply Chain Visibility Helps Companies Stay Agile

Growth in consumer electronics and recurring business cycles in the electronics industry will continue to put pressure on the MLCC supply chain. Even after incoming capacity helps relieve the current shortage, I would expect we’ll be here again during the next business cycle. Large and small companies that use MLCCs for their designs need to stay agile as stocks from distributors and manufacturers fluctuate. Make sure to use the best electronics supply chain tools and search engines to browse stocks from distributors and find alternative parts. When you have visibility into the supply chain as you plan to move into manufacturing, you can ensure your product is manufacturable on-time and at volume.

When you need to stay agile as you manage the current MLCC shortage, the advanced search and filtration features in Octopart can help you find substitute components and suppliers for your designs. The electronics search engine features in Octopart can help you navigate integrated circuit shortages by giving you access to aggregated data throughout the supply chain. You can access distributor pricing data, parts inventory, parts specifications, and CAD data, and it’s all freely accessible in a user-friendly interface. Take a look at our integrated circuits page to find the components you need.

Stay up-to-date with our latest articles by signing up for our newsletter.