Automotive semiconductors are in short supply at the beginning of 2021.

Capacitor shortage, meet the automotive integrated circuit shortage. Revolving component shortages have been a challenge for a booming electronics industry since 2018, COVID-related shortages notwithstanding. During 2020 it was a variety of integrated circuits and passives, including particularly high demand for SMD capacitors that culminated in a full-blown MLCC shortage by the end of 2020. During the COVID lockdown period, this was driven by demand for personal computers, smartphones, and other consumer electronics, many of which became necessities for at-home work and school.

With the new year upon us and the US economy in slow recovery, many digital and electronics-driven trends that were already in play before COVID have been accelerated. Everything from quantum computing to embedded AI and autonomous vehicles has seen massive investment, and it’s creating greater demand for semiconductors. In a recent report from McKinsey, automotive electronics are expected to see “year-on-year growth of 28 to 36 percent.”

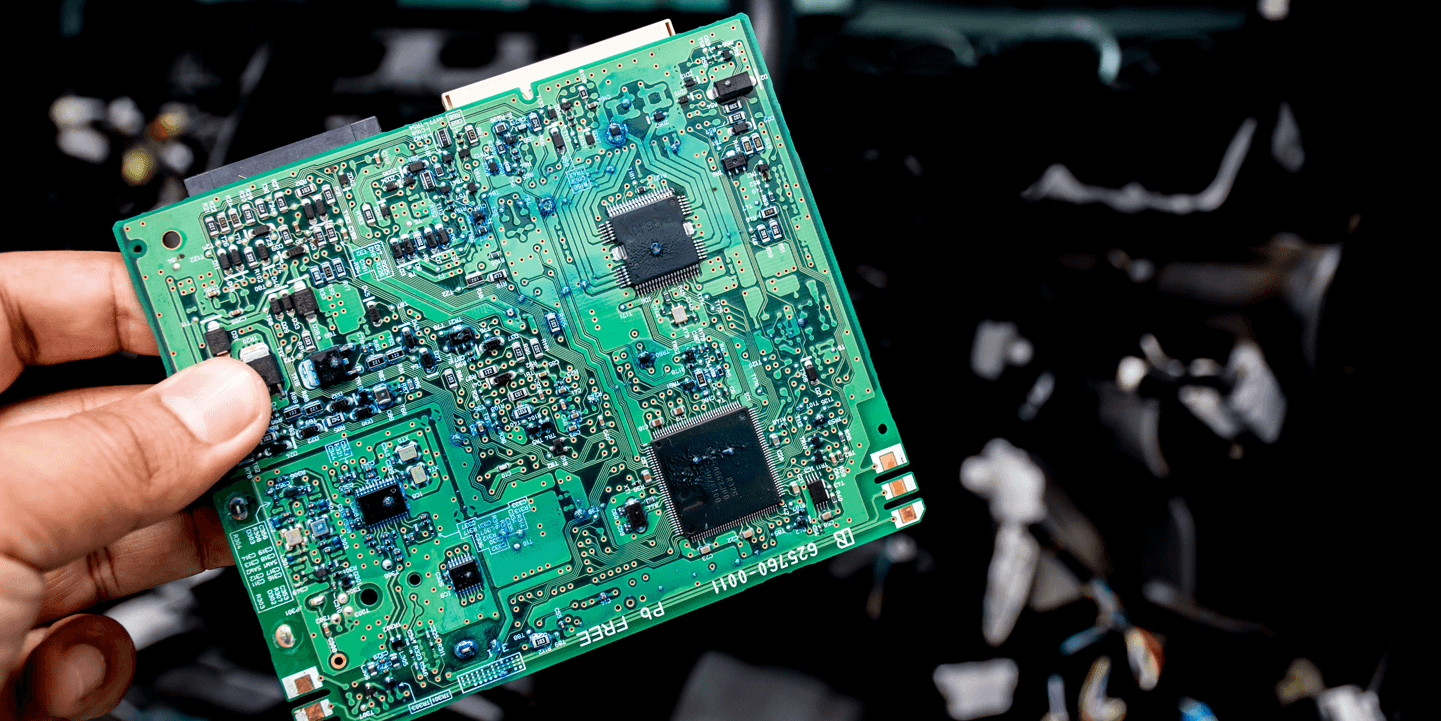

The shortage is particularly acute in the auto industry, causing temporary shutdowns at assembly plants. It’s amazing how a $1 integrated circuit can delay delivery of a $30,000 vehicle. Now that we know the effects of this newest shortage in an unexpected industry, what’s driving the shortage, and which products are being affected?

What’s Driving the Automotive IC Shortage

There are a few key factors driving the automotive IC shortage, and they reveal some fundamental aspects of the semiconductor industry, as well as today’s geopolitical realities. The affected components span everything from MCUs to MOSFETs and PMICs, primarily automotive-grade (SAE qualified) components at legacy nodes. While production capacity at home dipped and helped drive the shortage, as discussed by the Semiconductor Industry Association, there are other factors driving this new electronic component shortage:

Consumer Demand

The newly-found work-at-home lifestyle, home-schooling of children, data center and telecom infrastructure, and the newest consumer gadgets all combine to create greater demand for integrated circuits. Most of these products include CPUs or some other processors like MCUs or SoC. Components from across leading and legacy nodes are used in these products, as well as passives, discrete semiconductors, and many other components. Growth in supporting technologies, like cloud and data centers, is another factor affecting supply. This high growth in consumer electronics demand places pressure on legacy node products found in automobiles.

Outsourced Semiconductor Manufacturing

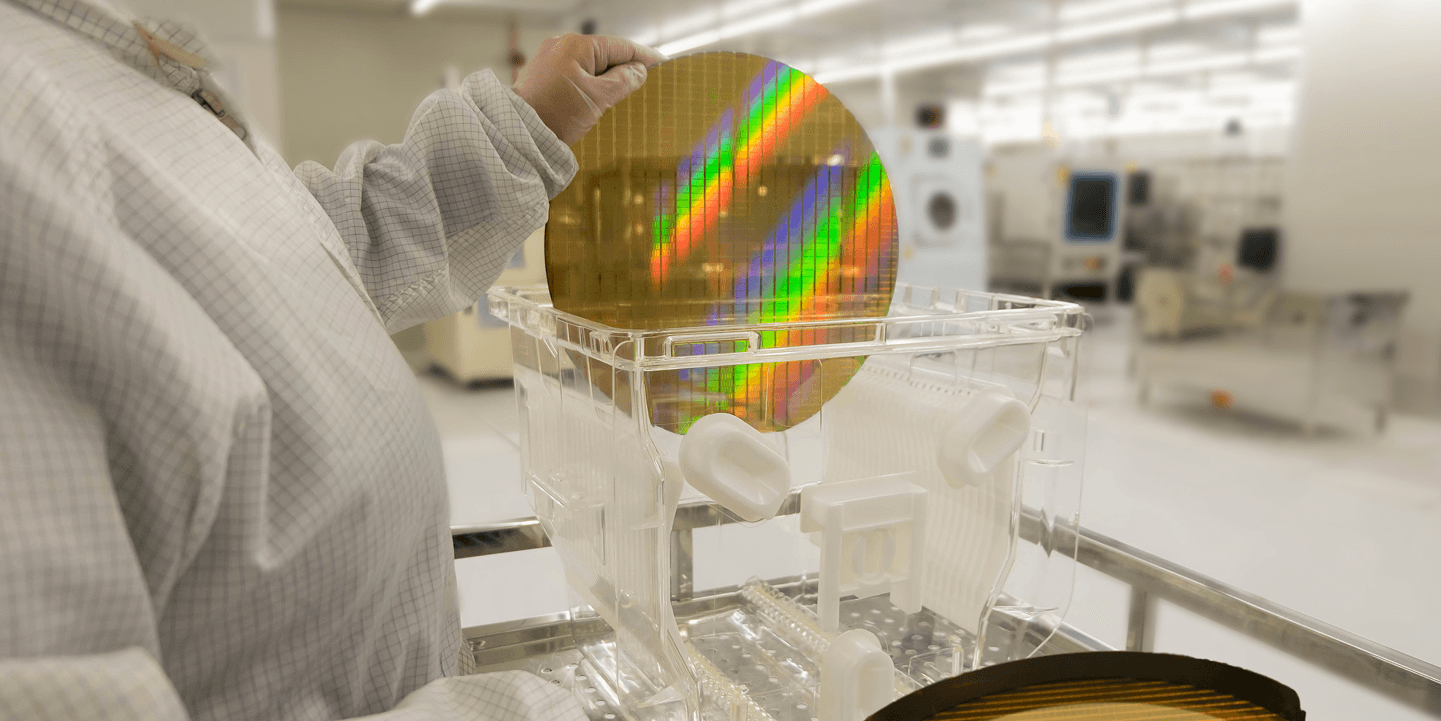

The automotive IC shortage underscores the effects of fabless semiconductor manufacturing on the supply chain. With many companies that produce ICs outsourcing production, and with so much demand coming from other sectors, car companies are low on a foundry’s list of priorities. Companies like TSMC earn a huge amount of revenue on volume orders for these components, of which ICs for automobiles comprise a relatively small fraction. Car companies now have to compete with every other sector of the electronics industry for wafer capacity in overseas foundries.

Wafer fab capacity is in short supply as automotive chip makers compete with components targeting other industries.

In addition, many ICs for automobiles do not have a large number of replacements. These components may have SAE qualifications that can make them desirable in other non-automotive products, such as in robotics or industrial systems. Now that demand for new autos has returned faster than the carmakers expected, foundries are slammed trying to serve every industry at once.

Just-in-Time Supply Chains

Car companies have been able to take advantage of the just-in-time supply chain for semiconductors and other components required for their vehicles. This has allowed car companies to hold less inventory and adjust orders to meet changing demand. Unfortunately, once the supply chain gets disrupted with excess demand for critical components, and those components don’t have replacements, you end up with a shortage. This is yet another argument for decreasing reliance on just-in-time logistics and possibly on-shoring some production capacity.

Tariffs and Sanctions

Some have said that the situation with automotive ICs is evidence the trade war with China is backfiring. Although tariffs were meant to protect American production and manufacturing interests, placing sanctions on the bottom of the supply chain without sufficient replacement production capacity creates a shortage once capacity is used up. Chip and PCB production has moved around Southeast Asia in response to sanctions and tariffs, including to TSMC, only to find that capacity is already allocated to other customers.

Shortages Span Beyond Automotive

In 2020, it was constant crunch time for designers and EMS services, forcing orders to be cobbled together from multiple vendors to meet production orders, something which I got to experience first-hand. Today, shortages are happening across product lines. A statement from Foxconn’s chairman in December notes that we can expect these shortages to continue into 2021, and there does not seem to be any sign the situation will change soon.

While the shortage of automotive-qualified components and production line shutdowns are what have been making the news, the IC shortage spans beyond the automotive industry. Some other products affected by these shortages include:

Sony blames the chip shortage for delays in Playstation 5 production

5G base station equipment

Smartphones, particularly the new iPhone

With revolving component shortages becoming the new normal, designers need up-to-date information on the supply chain to determine the best components for their systems. Designers can also navigate the current shortage with search tools that aggregate data from across the supply chain. This helps a team save time browsing distributor websites, calling vendors, and replacing out-of-stock components in their designs.

When you need to stay updated on component stocks and find parts for your design, use the advanced search and filtration features in Octopart. The electronics search engine features in Octopart can help you navigate integrated circuit shortages by giving you access to aggregated data throughout the supply chain. You can access distributor pricing data, parts inventory, parts specifications, and CAD data, and it’s all freely accessible in a user-friendly interface. Take a look at our integrated circuits page to find the components you need.

Stay up-to-date with our latest articles by signing up for our newsletter.