If you’ve been paying attention to the news, social media, or just your group of friends, then you know everyone is talking about coronavirus (COVID-19). On March 11th The World Health Organization declared the outbreak a pandemic. Regardless of your feelings about hand sanitizer or keeping your kids home from school, there is one thing everyone can agree on: the effects of COVID-19 on manufacturing supply chains is real and is affecting the broader economy.

Chinese contract electronics manufacturers, including component manufacturers and PCB fabricators/assemblers, are contributing to the supply chain pains felt in the industry. The US PCB manufacturers I know have cited COVID-19 as one reason they’ve seen an uptick in fabrication and assembly orders as of late, but time will tell if this trend continues. Despite a blip of good news on the radar, many manufacturers and components suppliers are struggling to keep up with demand for new electronics, which is contributing to market volatility and a broader economic slowdown. It all comes back to supply chain hiccups due to temporary factory closures overseas.

COVID-19 and its Impacts in the Electronics Supply Chain

The beginning of the second week in March was quite interesting. News of COVID-19 had been pushing stocks down for some time, and the news that has accumulated during the first two months of 2020 began to set in as a new normal. The major indices are showing some volatility as major tech companies and manufacturers saw their valuations drop. Despite the drop, areas like consumer durables and healthcare were up ~20%.

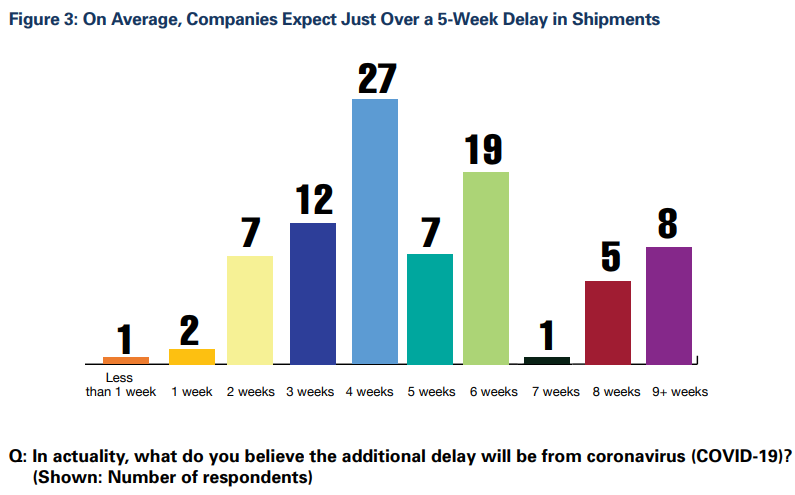

The shift in valuations comes back to electronics supply chain volatility and component shortages. Although it doesn’t tend to come out in most news broadcasts, electronics manufacturers have been outspoken regarding the effects of COVID-19 on operations, and on the supply chain in particular. On February 27, results from an IPC survey revealed that roughly 65% of electronics companies would experience delayed component shipments, with delays reaching four to six weeks.

Some results showing expected shipment delays by large mid-chain electronics manufacturers due to COVID-19. Source: IPC.org.

This all comes back to satisfying consumer demand in industrialized countries, which is affecting the bottom line. Apple, Microsoft, and other tech companies stated they would miss their Q1 2020 revenue targets, due in part to supply chain, labor, and logistics problems caused by the COVID-19 outbreak. The disruption in the components supply chain is causing major disruptions farther up the supply chain pyramid and for the industry as a whole:

- Global notebook shipments for Q1 2020 are estimated to fall by 29% to 36% compared to the previous year due to labor and component shortages in China.

- According to research firm IDC, smartphone shipments in China will likely fall by 40% in Q1 2020 compared to the same period last year. This equates to 33 million fewer phones purchased in China. The expected drop without COVID-19 was only 5%.

- India’s technology ministry has asked its electronics industry lobby groups to provide a list of components that can be airlifted from China in order to prevent an upcoming component shortage for Indian manufacturers. The supply chain problems in India also include electrical and mechanical automotive parts.

- Important industry events like Embedded World, Facebook’s developer conference, and the Mobile World Congress have been cancelled to prevent further spread of COVID-19. Major manufacturers like Intel have restricted employee travel in order to prevent further disruptions.

- Laptop stocks for major consumer brands (e.g., HP and Dell) are running low, and end consumers may experience delays in smaller devices like headphones and wearables. Spot shortages are already being seen for products like Apple’s iPad Pro.

The component shortage and delays for finished products are less likely to create major problems for consumers. Analysts are expecting consumers to see more spot shortages or somewhat increased prices; the real difficulties are felt farther up the supply chain, where manufacturers now need to cobble together component stocks from different distributors outside of China. The Chinese manufacturing community has every incentive to get people back to work as manufacturing is a major economic driver in China.

How Are Manufacturers Adapting?

Simply put, it’s a mad dash to cobble together orders from multiple sources and keep customers informed of the situation. Large OEMs are feeling the heat from a logistics standpoint; even after the shortage ends and Chinese factories are producing at full capacity, manufacturers should expect longer than normal lead times due to overwhelmed air and marine transport. Not all PCB fabricators are affected as they are proactively identifying risk on a part number basis, and they are responding by looking to alternative sources.

EMS companies with manufacturing capacity in China are taking proactive steps to avoid a quarantine. A single worker arriving at the factory with a cough or fever creates a risk of a 2 week government-mandated quarantine at the factory. In cases where suitable replacement sources can be found domestically, EMS companies are taking advantage of these sources when cost allows and when raw material lead times are minimal. Domestic (US/EU) bare PCB fabricators are seeing a boost in new orders.

Chinese factories are slow to bring operations back to full strength after the Lunar New Year thanks to COVID-19.

Overall, the COVID-19 situation underscores an over-reliance on the Chinese manufacturing sector, and companies with manufacturing capacity in China need to diversify their supply chain risk. This will help alleviate stress on their customers farther up the supply chain. Companies can respond to supply shortages by reengineering certain products with suitable alternative components and producing end products for which all components are still available. This all relies on electronics manufacturers and designers having real-time supply chain visibility from component distributors, including component stocks, lead times, and MOQs.

Now more than ever, everyone from large electronics companies to individual designers need supply chain visibility as they search for the components they need for new products and distributors to supply them. Octopart’s search engine compiles information from major global electronics distributors, component manufacturers and independent distributors in the same place, giving you a full view of the global electronics supply chain.

Stay up-to-date with our latest articles by signing up for our newsletter.