Back in the good ol’ days of 2019 and earlier, the supply chain discussion tended to revolve around product lifecycles, the occasional component shortage, and counterfeiting. Today, in the wake of COVID-19 and the second wave of cases sweeping the industrialized world, those problems seem easy compared to the factory closures, widespread shortages, and all-around uncertainty. Although attention has shifted, those earlier supply chain challenges will still need to be confronted after modern life returns to normal.

Manufacturing and sourcing problems from COVID-19 aside, professional associations, research firms, and manufacturers in the industry were already discussing some important electronics supply chain manufacturing challenges. Ever since March 2020, the conversation has become almost entirely centered around COVID-19. The broader, long-lasting supply chain challenges aren’t going away anytime soon. Here are some of the important challenges the industry will need to confront to create a more responsive, less risky, more diversified electronics supply chain.

Major Electronics Supply Chain Management Challenges

The current landscape for electronics sourcing was in turmoil during 2020 and is likely to remain this way going into 2021. Today’s just-in-time global supply chain is designed to allow buyers to identify the perfect tradeoff between minimum lead time and lowest possible price. Higher prices might be tolerated if it means we can meet a production schedule with higher volume, or you might be willing to accept a longer lead time if it saves you a few cents per part.

In normal times, buyers largely have the freedom to pick and choose their sources and can take advantage of a healthy logistics system, despite shortages, counterfeits, and tariffs. At the beginning of 2021

EMS companies and OEMs experienced long component lead times and shortages during 2020.

The components industry felt erratic demand, leading to erratic supply, but was in a growth state by the end of 2020.

The industry overall fared very well compared to industries like retail and tourism.

Fundamental parts made with legacy technologies are still experiencing shortages.

Electronics buyers are now concerned there will be new shutdowns and restricted activity early in 2021.

With these results in mind, we can see three critical electronics supply chain management challenges faced by the electronics industry in 2021:

Lack of Diversity

Although there are dozens of primary and secondary electronics distributors, some of whom have official relationships with major component makers, there are comparatively fewer major manufacturing centers for components. Geopolitical turmoil in the form of a global pandemic and tariffs have helped make this lack of manufacturing diversity painfully obvious. In addition, the just-in-time supply chain model we’ve come to love relies on predictability; this model is slow to adapt to sudden shocks like widespread quarantines.

Shorter Product Lifecycles

Shorter lifecycles come about due to more rapid advances in technology and changes in consumer behavior, which then create inventory management headaches. Companies have to carry extra inventory to address customer demand, and they have to turnover inventory more often. This increases inventory carrying costs and risks to the bottom line, particularly if a product fails. Reliance on a centralized manufacturing base then makes it difficult for companies to procure the components they need in the event of obsolescence or global supply chain disruptions.

Commoditization and Product Complexity

This partially explains shorter product lifecycles; every portion of the supply chain and design chain has become commoditized, and companies keep pushing newer and more complex product variants in order to remain competitive. This is great for the consumer and end customer as it drives competition, pushes down prices, and helps enable the features we all enjoy in consumer products. However, it has forced OEMs to outsource just about everything except the most critical IP, as long as regulations (e.g., ITAR) don’t prevent this. I would argue this has indirectly contributed to the rise of China as a manufacturing powerhouse and the centralization of manufacturing capacity in Asia.

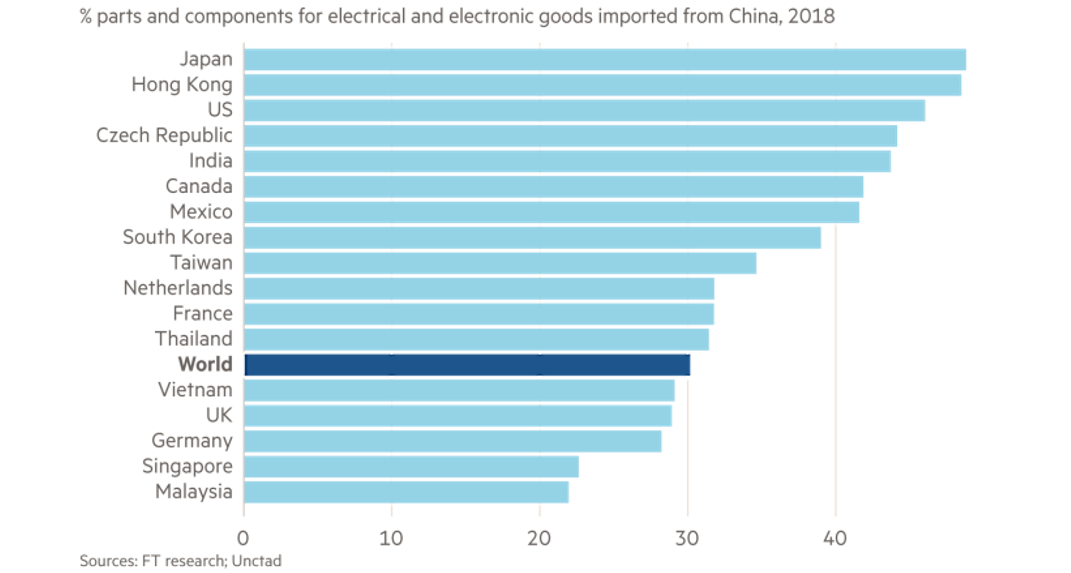

Problems with the single-source electronics supply chain stem from over-reliance on China.

The graph above shows just how much everyone relies on China as the world’s factory. Even though the conversation in mid-2020, including by the IPC as a driving lobbying force, focused on moving capacity away from China and accelerating onshoring, China still ended 2020 with a record trade surplus. This probably shouldn’t surprise anyone as Chinese exports are supporting the new stay-at-home normal in the COVID-19 era.

Addressing all three challenges is all about reducing risk and diversifying the electronics supply chain away from Asia, particularly China.

Expect More Diversified Supply Chains

Globalization has been great for consumers in advanced countries and has helped raise wages and improve livelihoods in poorer countries, although the ethical questions around working conditions and environmental damage need to be addressed. Labor cost differentials in China and other countries in the region have started to close, and recent global turmoil is forcing OEMs and EMS companies to rethink the benefits of a wage differential: lower labor costs bring increased risk, which can be unacceptable for critical components.

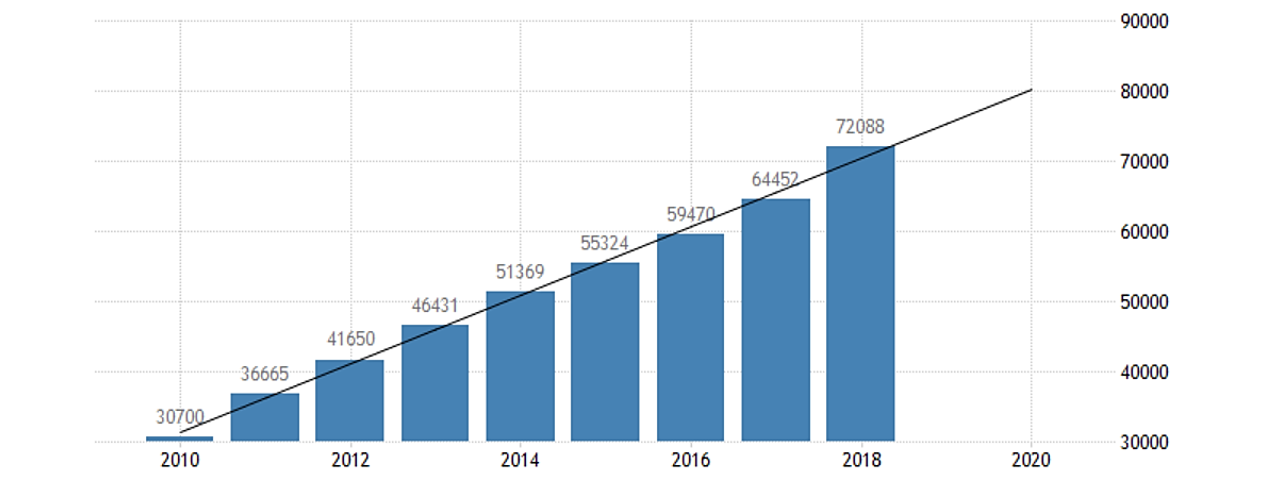

The gradual rise of labor costs and the emergence of a Chinese middle class caused the industry to rethink the use of China as the world’s manufacturing hub. The discussion centered around developing regional manufacturing and distribution hubs to eliminate China as the single source for many components and cheap assembly services. It’s possible the effort was not seen as being worth the time and capital investments simply because no one likes to think about Black Swan events. In addition, the entire network of suppliers is still located in Chinese hubs.

Changes in average annual Chinese manufacturing wages since 2010 (in CNY). Source: Trading Economics.

Now, tariffs, COVID-19, and the relative failure of global just-in-time logistics create new motivation for regionalization of critical manufacturing and distribution capacity. If systems integrators, sub-systems OEMs and assemblers, and component suppliers can diversify their supply chain risk away from Asia and bring supply chains closer to home, they can see a number of benefits:

More sources brings less risk: Spreading manufacturing capacity over a broader geographic region, and bringing it close to home, reduces risk of regional disruptions, such as tariffs.

Traceability: When components move through fewer hands, there are fewer opportunities for counterfeiting. This also makes components and raw materials easier to trace.

Easier to protect IP: Spreading different portions of a new product’s manufacture and assembly to different regions, or bringing it in-house, reduces risk of IP theft. IP theft may also become easier to trace when the supply is more localized.

The U.S. is already moving in this direction. Onshoring received less attention in 2019 than in 2020, and the Trump administration was pushing an initiative to onshore industrial supply chains in order to reduce reliance on China. It remains to be seen how Biden’s proposed trade policies will affect the dynamic or drive further onshoring. The EU is working towards the same goal, particularly for pharmaceutical manufacturing. This is a complex challenge, but it is worth undertaking in the face of supply chain disruptions and shifting manufacturing capacity that was seen in 2020. For now, manufacturing is staying put in southeast Asia according to Forbes amid fear of new lockdowns, but that may change as vaccine rollouts continue.

Whether components manufacturing capacity remains clustered in China or spreads back to local regions, Octopart has the tools you need for electronics supply chain management and visibility. When you’re looking for components for new products, try using the component search and filtration features from Octopart. Try our Part Selector guide when you’re looking for electronic components.

Stay up-to-date with our latest articles by signing up for our newsletter.