The effects of coronavirus on manufacturing capacity are starting to be felt in the US and Europe due to government restrictions, lockdowns, closures, and shelter-in-place orders that have all contributed to reducing manufacturing capacity. While these measures may be necessary to help stem the tide of coronavirus in Western countries, they are affecting production capacity for all types of products, including consumer electronics.

The effects on demand, productivity, and manufacturing capacity in Western nations is mixed. Some larger companies with overseas operations are not feeling so strained, while smaller manufacturers in some communities have been forced to temporarily shut down operations and layoff workers. We’ve compiled some of the latest developments on the coronavirus situation for the electronics community so that you can determine the best path forward for your business.

Manufacturing Landscape for US and European Manufacturers

Everything from clothing to electronics retailers are seeing supply chain volatility due to temporary factory closures in China. In the electronics industry, difficulties sourcing raw materials and components have caused order delays and price swings during Q1 2020. As of March 19, the New York Times reports that China has hit a milestone with no new local infections being reported. This is great news as it allows Chinese manufacturers to reopen factories and get workers back on production lines.

Although this is one bit of good news amidst global turmoil, the burden of closing factories, offices, and stores has shifted to Western countries. Some major US cities, such as San Francisco, the surrounding Bay Area, and Portland as of March 20, have enacted or are considering shelter-in-place orders, where non-essential businesses are ordered to close and citizens are asked to stay at home. All-out lockdowns have been or will soon be enforced in European states, which have collectively experienced approximately 75% of all deaths from coronavirus.

When these and similar orders will end is still an open question, but these orders are curtailing electronics manufacturing capacity in the US, Europe, and other countries. Although there have been major impacts on many supply chains, the electronics supply chain has not seen the same impact as other industries. In an odd twist of fate, Chinese manufacturing capacity is coming back online at the exact moment it is being impacted in the US, Europe, and southeast Asia. Some US manufacturers and larger companies will have a chance to weather the storm thanks to this turn of events. Here’s how domestic and multinational electronics manufacturers are faring:

Large OEMs and EMS Providers

Larger companies with Chinese operations are seeing their overseas capacity expand just as capacity elsewhere becomes at-risk of contracting. OEMs and EMS providers with operations in multiple countries are seeing their manufacturing capacity shift back to China as governments start implementing limited or total lockdowns (especially in Europe). Multinationals will have a tough time managing the production capacity as the lockdown situation changes.

This highway in Manila, Philippines would normally be full of cars. A government lockdown was enforced starting March 15, which caused Integrated Micro-Electronics to suspend work at its Luzon, Philippines facilities.

This highway in Manila, Philippines would normally be full of cars. A government lockdown was enforced starting March 15, which caused Integrated Micro-Electronics to suspend work at its Luzon, Philippines facilities.

Larger Chinese EMS providers are starting to see their capacity return to normal, and their American customers are doing what they can to get new products into production, despite remaining supply chain volatility. Foxconn and Hon Hai Precision Industry Co. are hoping their capacity returns to normal by the end of March, both of which respectively produce and assemble products for Apple.

Medical, Aerospace, and Defense Manufacturers

These US companies have largely kept their domestic manufacturing capacity active during the coronavirus crisis. Regarding medical device and equipment manufacturers, President Trump invoked the Defense Production Act at the highest level on March 20, although the current focus is on obtaining face masks and test kits. This wartime measure allows the administration to force American manufacturers to produce medical products that are in short supply and sell them to the federal government. While this won’t fully apply to the electronics industry, it will give a boost to equipment like smart thermometers and respirators.

PCB Fabricators

In the Bay Area, companies are remotely providing essential design and quoting services, while out-of-state or overseas companies are handling fabrication and/or assembly. Fabricators outside the Bay Area are following social distancing guidelines, where non-essential employees are being asked to work from home if their jobs allow. If other cities and states impose sweeping shelter-in-place orders, other companies may have to follow the same trend as Bay Area companies and rely on out-of-state or overseas fabrication services to keep up with demand. The exception to this is any “essential business,” which could include designers, fabricators, and local EMS providers working on defense and medical products.

Beyond Coronavirus and Manufacturing

Despite the logistics challenges and shuffling of manufacturing capacity worldwide, the electronics industry has been largely spared from widespread shortages. Consumer products have seen spot shortages and some order delays, and EMS providers have had to scramble to obtain components, but Chinese manufacturing capacity is ramping up at the time it is needed most.

The real danger for the electronics industry is consumer sentiment, which filters back through the supply chain as reduced demand. Many consumers have seen their work hours reduced, been laid off from their jobs, or been forced to close their businesses. This translates into reduced spending for a prolonged period, even after coronavirus is under control and new cases are on the decline.

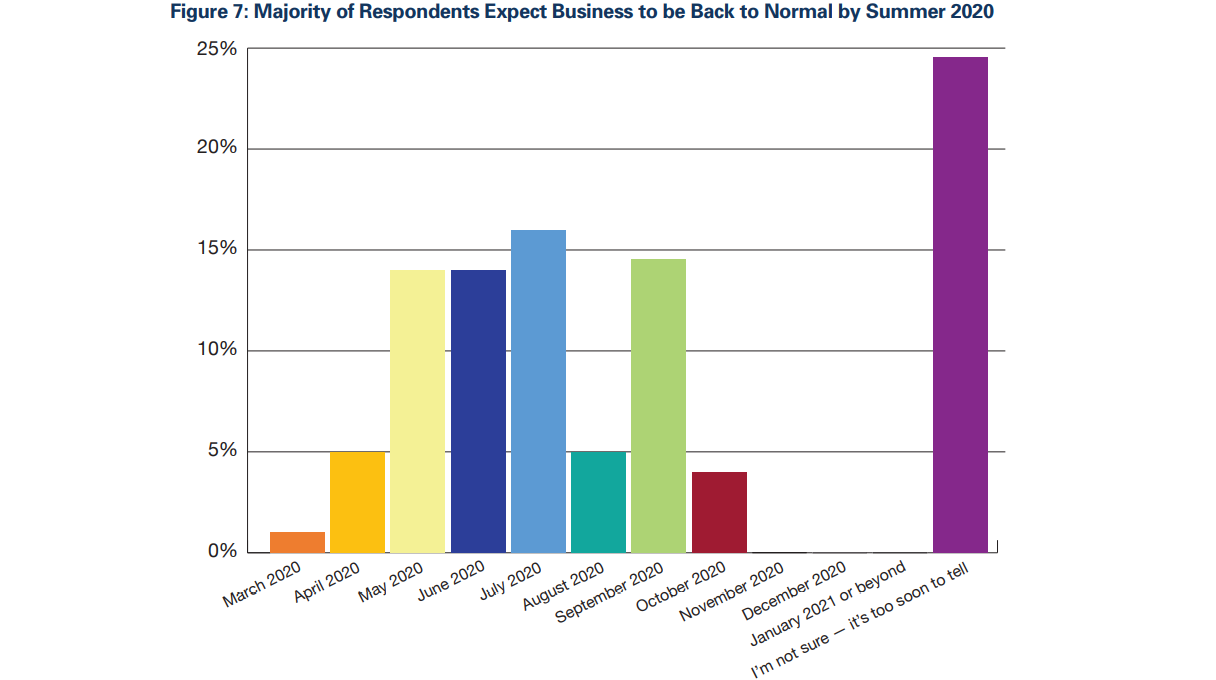

Based on consumer sentiment and fluctuations in capacity, electronics manufacturers should plan for reduced orders until Q3 or Q4 of this year. According to a recent IPC survey, responses from member companies show that they expect to see reduced orders throughout 2020, and respondents don’t expect business to be back to normal until at least June. If news changes and consumer sentiment turns positive, one can expect electronics sales and the global economy to rebound much sooner.

IPC member company responses showing expectations when business conditions will return to normal. Source: March 2020 survey update from IPC.org.

IPC member company responses showing expectations when business conditions will return to normal. Source: March 2020 survey update from IPC.org.

If you’re interested in a more in-depth discussion around the electronics supply chain and its broader effects on electronics manufacturing, watch a recent OnTrack Podcast with Altium’s Judy Warner and Mike Buetow, Vice President and Editor in Chief at PCD&F Circuits Assembly,

The effects of coronavirus on manufacturing are changing daily, and everyone from designers to EMS providers need access to the latest supply chain updates to keep up with latest developments. Octopart compiles electronic component prices, stocks, lead times, and much more into a single platform, allowing large electronics companies and individual designers to access the newest components with current sourcing information.

Stay up-to-date with our latest articles by signing up for our newsletter.